-

Posts

186 -

Joined

-

Last visited

Contact Methods

-

Website URL

http://www.gapinsurance.co.uk

Profile Information

-

Gender

Male

-

Location

Holmfirth

Car Info

-

Model

SKODA Kodiaq

Recent Profile Visitors

2,717 profile views

David@GAPInsurance's Achievements

-

GAP insurance is a type of insurance that aims to top up your motor insurer's valuation of your vehicle to a higher amount, in the event that your vehicle is written off through accident, fire, theft, or flood etc. There are different types of GAP insurance but, our Invoice GAP insurance for example, aims to top up your motor insurer's total loss valuation of your vehicle at the time of claim, to the highest of either: The amount (if any) outstanding on finance at the time of claim, or The original invoice price that you bought your vehicle for, when you first bought it. Putting aside the benefit of the additional funds to help you sort a replacement vehicle, though... How long could you be without a car for? A historical "gap" (if you'll pardon the cheap pun) between a motor and GAP insurance policy is, your ability to remain mobile whilst your total loss claim is being processed. A standard motor insurance policy would usually only provide you with a courtesy car to use up and until the motor insurer decides that the vehicle is a Total Loss (aka they "write it off") - at which point they'd usually take their courtesy car back off you, but this could be days or even weeks before you're able to be back mobile again in another vehicle. Even if you built in "guaranteed car hire" (or whatever your motor insurer's equivalent is) to your motor insurance policy at extra cost - which is supposed to ensure that you get to retain their courtesy car beyond the point of total loss - this is often limited to a maximum of 21 days use of that car. How long does a Total Loss claim take? Our statistics show that whilst on average our GAP insurance claims are settled within 5-working days of all paperwork being in order, this settlement is on average around a month from the actual incident that led to the total loss claim... or in other words, around a month after you first lost the use of your vehicle. So... you've waited up to a month, your claims have been paid, and you're in receipt of the funds, but how much longer is it going to be before you're back mobile again in a replacement vehicle? Enter: Total Loss Courtesy Car Cover (TLCc) Earlier this year, we re-launched our GAP insurance policies with the ability, at the time of purchasing cover, to build in the provision of a Total Loss Courtesy Car for you to use for up to 28-days in the event of a total loss claim. What's more, the courtesy car provision kicks in from the point you're no longer eligible for the courtesy car from your motor insurer. E.g. if (as mentioned above) your use of your motor insurer's courtesy car as a result of a total loss claim is limited to 21 days, we'd then provide our courtesy car for you to use for up to a further 28 days etc - keeping you mobile for longer, whilst you organise your next vehicle. Want more info? You can read more about Total Loss Courtesy Car cover here. You can read more about GAP insurance in general here or the specific types of GAP insurance we offer using the links below: Contract Hire GAP insurance Invoice GAP insurance Replacement GAP insurance Top-Up GAP insurance If you've bought a car in the last three months or in the process of buying one, get a GAP insurance quote from GAPinsurance.co.uk here. Remember that forum members get a 10% discount through the use of discount code: BRISKODA10.

-

We ask all our customers how much their motor dealer quoted them for GAP insurance when they bought their new (or used) car. Here we compare average 3-year Invoice GAP insurance prices in 2022 so far. If you've bought a car in the last three months, or are buying a car soon, get a quote at GAPinsurance.co.uk and whilst you're at it remember to use code BRISKODA10 to save 10% If you've recently paid over the odds for GAP insurance from a motor dealer, all is not lost. You have a statutory right to cancel that policy within the first 14 days (though most companies allow 30-days) and you should receive a full refund if you do.

-

- gap insurance

- new car

-

(and 3 more)

Tagged with:

-

Hi. I only just saw this. I hope I'm not too late. For a Personal Lease (PCH) agreement, you need to be looking at a Contract Hire GAP insurance policy. In the event that your vehicle is declared a Total Loss, this type of cover aims to pay the difference between your motor insurer's valuation of the vehicle and the early termination fee (aka "settlement figure") due to the finance company. The method of calculating this early termination fee varies (sometimes considerably) from one finance company to another but as a general rule, it usually consists of their (the finance co's) perceived value of the vehicle at the time of loss plus something towards the rentals due to the end of the original agreement term. This something can range from a small percentage to almost the entire balance but is often around 50% of the sum of all rentals. Contract Hire GAP insurance cover will usually contribute £250 to any excess deducted by your motor insurer for that Total Loss claim and in most cases, you're also able to build in cover that would see you reimbursed up to £3,000 of the initial rental you paid at the start of the lease. Separately, in your post, you mention "new car for 1st year" - commonly known as "New-For-Old" cover. You should approach this with caution, though. It's usually the case that New-For-Old cover from your motor insurer is conditional upon you being the first and only registered keeper of the vehicle from brand new. Given that with a Contract/Lease hire agreement it's the finance company who are named on (and who will retain possession of) the V5 registration document, you're never the registered keeper of the vehicle and the considerable majority of cases would therefore be ineligible to benefit from the New-For-Old cover by default. Even if your motor insurer *did* permit such cover for leased vehicle, it's still fraught with potential issues. You can read more about them here: Myth: You Do Not Need GAP insurance In The First Year You can see more about Contract Hire GAP insurance on our website: GAPinsurance.co.uk and if you use code BRISKODA10 you'll get 10% discount off our quoted premium too. Cover is available for durations of up to 5-years and can be purchased at any time so long as there's more than 12 months remaining on your lease. Although if you require cover for your lump sum initial rental of up to £3k, you need to purchase cover within the first 12 months of the lease. Our policies are 5-star rated and, underwritten at Lloyd's of London. If you require any further guidance, please don't hesitate to get in touch. David

-

In the year to August 31st, our customers saved an average of £239 each, when buying GAP insurance from us instead of from a car dealership. One customer saved a staggering £1,320! Yes... you read that right... one THOUSAND three hundred and twenty pounds! Don't be ripped off by a car dealer: you do NOT have to buy GAP insurance from them. Whether you're buying a new car, or a used car, cash outright, financing or leasing it... get a GAP insurance quote here and see how much YOU can save! ABOUT US Starting in March 2004 we were the UK's first specialist online broker of GAP insurance. We offer 5-star rated GAP insurance policies, underwritten by UK-based A-rated insurers, at prices up to 85% cheaper than the equivalent (though usually inferior) policies sold by motor dealers. TYPES OF GAP INSURANCE: Invoice GAP Replacement GAP Contract Hire GAP Top-Up GAP GET A QUOTE HERE SEE OUR WEBSITE HERE GET IN TOUCH HERE FOLLOW US ON SOCIAL Twitter Facebook Instagram

-

- 1

-

-

- gap insurance

- invoice gap

-

(and 3 more)

Tagged with:

-

New Octavia 1.4 Hybrid Estate.

David@GAPInsurance replied to Biggles33's topic in Skoda Octavia Mk IV (2020 > )

That's still a high price. If that's something you've taken out recently you may still be in your cooling off period (even if you're not, with a cancellation fee to pay you could *still* save money). Check us out at https://gapinsurance.co.uk/skoda/ for a quote to compare. Code BRISKODA10 will grant a further 10% discount too. -

New Octavia 1.4 Hybrid Estate.

David@GAPInsurance replied to Biggles33's topic in Skoda Octavia Mk IV (2020 > )

I appreciate the frustration... on the subject of GAP insurance specifically, that they did this is really quite interesting. It's been illegal since September 2015 for a motor dealer to both introduce GAP insurance to you and conclude the sale of it on the same day. There has to be at least two clear days between them providing you with the "prescribed information" about GAP insurance - this very specific information is supposed to detail all the main features, benefits and exclusions along with an instruction that GAP insurance cover is optional and can be purchased from other providers - and them then concluding the sale of a policy with you. E.g. if they first introduce the topic of GAP insurance to you on a Monday, it would be Thursday at the earliest before they'd be legally permitted to raise the topic of it again with you. Although, you do have the right to waive your option to wait until the Thursday and if you wish can instruct them on the Tuesday or Wednesday that you wish to purchase cover but, this cannot be through encouragement from them. Sadly... the attention that motor dealers have been paying to these rules since 2015, has been lacking somewhat -

New Octavia 1.4 Hybrid Estate.

David@GAPInsurance replied to Biggles33's topic in Skoda Octavia Mk IV (2020 > )

£500 for GAP insurance on such a vehicle is extreme to say the least... by comparison I'd expect our 3-year Invoice GAP insurance policy to be somewhere around £150 - £170 in total (using discount code BRISKODA10). Check us out at GAPinsurance.co.uk/SKODA -

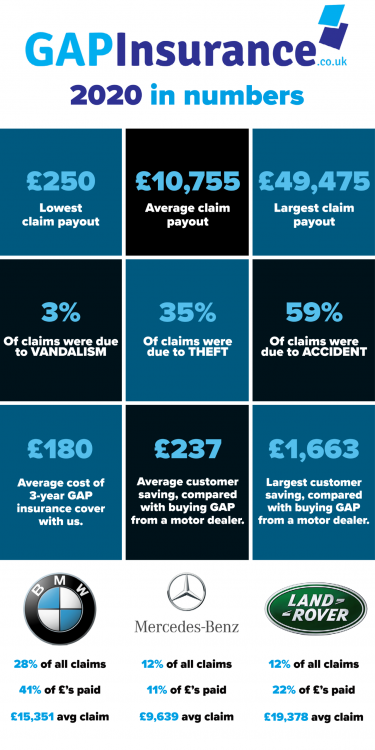

In 2020, our customers saved an average of £237 buying GAP insurance from us instead of from their motor dealer. One customer saved a staggering £1,663! 59% of all claims were due to accidents, whilst 35% were due to the vehicle having been stolen. Is GAP insurance worthwhile? At an average cost of just £180 for 3 years’ cover, and an average payout of £10,755 on top of what they received from their motor insurer, we think our policyholders who claimed in 2020 would say it was! If you're considering GAP insurance for a car you recently acquired or a new one you're getting soon, please see GAPinsurance.co.uk/skoda or call us on 01484 490095 10% Discount code: BRISKODA10

-

If you've bought a car in the last 3-months, or will shortly be doing so, today would be a good time to buy GAP insurance: Get 20% off using code BLACKFRIDAY20 at GAPinsurance.co.uk

-

- gap insurance

- discount

-

(and 1 more)

Tagged with:

-

September 1st is looming and the new 70-plate registration is almost upon us. If you’re lucky enough to be getting a brand new car, GAP insurance should definitely be something you’re considering, but what exactly is the difference between Invoice (‘Return to Invoice’) and Replacement GAP insurance? Moreover… which type is better for you and your car? We explain all in our latest blog. Have a read, here. If you need a quote for GAP insurance, check out our website at GAPinsurance.co.uk or reach out to us by calling 01484 490095 or emailing [email protected]. BRISKODA members get 10% discount by using code: BRISKODA10 GAP insurance is available for cars up to 8-years old, bought from a motor dealer within the last 3-months. Certain vehicles are excluded from cover. See here for a full list of excluded vehicles.

-

- gap insurance

- rti

-

(and 6 more)

Tagged with:

-

Is your GAP insurance policy about to be cancelled? Following on from this: LAMP insurance in liquidation, our competitor Warranty Direct has announced that GAP insurance policies sold via their GAPCoverInsurance.co.uk website until May of this year are going to be cancelled effective from August 29th. They've published a list of FAQ's here too. If you have a GAP insurance policy underwritten by LAMP, you'll now need to source alternative cover... here's how we (GAPinsurance.co.uk) might be able to assist you: Contract Hire vehicles delivered after February 21st 2019 We may be able to offer you Contract Hire GAP insurance. See here for more details (available for vehicles delivered up 6-months ago). Vehicles purchased (cash or finance) and delivered after May 21st 2019 We may be able to offer you Invoice GAP insurance or (if the vehicle was brand new and you were the first registered keeper) Replacement GAP insurance. For more details about Invoice GAP insurance, see here (available for vehicles delivered up to 3-months ago). For more details about Replacement GAP insurance, see here (available for vehicles first registered up to 3-months ago). Vehicles outside of the above criteria If your vehicle is less than 8-years old, worth no more than £80,000 and isn't specifically excluded from cover, we may be able to offer you Top-Up GAP insurance. See here for more details. Why you should avoid unrated insurers: LAMP insurance is the fifth unrated insurer of GAP insurance to have gone bust since 2016 (both Enterprise & Elite insurance of Gibraltar along with both Alpha & Qudos insurance in Denmark being the other four that went to the wall previously). In each of the other cases another insurer stepped in to purchase the still live policies and allow cover to continue in one form or another. It was however only a matter of time, before an unrated insurer of GAP insurance went bust and no other insurer stepped in - as people with LAMP underwritten policies are now experiencing. Even today, despite the increased risks of using an unrated insurer, many of our online competitors do so in pursuit of offering the lowest possible premiums. All of them will tell you that it's "safe" because your policy is covered by the Financial Services Compensation Scheme (FSCS) but, what they usually fail to make explicitly clear is, that if the insurer goes bust and your policy is cancelled before you need to make a claim, the FSCS is actually only good for 90% of a pro-rata amount of the price paid for the policy - meagre compensation if your policy is cancelled when you're then too late to source equivalent cover from elsewhere and left without cover as a result. It's a message we've been harping on about for years. In our >15 years of trading, we (GAPinsurance.co.uk) have only ever and will only ever use A-Rated insurers. It might mean that our policies are a little more expensive but, the chances of an A-Rated insurer going bust are considerably less, which means the insurer is more likely to be around when you need to call upon the policy if your vehicle is written off. In our opinion, unrated underwriters of GAP insurance should be avoided at all costs, it's just too much of a risk - if you're currently considering cover or have recently purchased cover underwritten by an unrated insurer (generally speaking, unrated insurers are usually based in Gibraltar, Denmark or Malta - but not necessarily), you may want to reconsider your options again whilst you may still have the opportunity to source cover from elsewhere. If you're concerned about any of the above and wish to discuss your GAP insurance options, please get in touch on either 01484 490095 or [email protected]. HTH.

-

Contract Hire, Invoice & Replacement GAP insurance policies normally have to be purchased within a limited period of time after taking delivery of your vehicle (with us it's 6-months for Contract Hire GAP and 3-months for Invoice & Replacement GAP). Further... once cover is in place, they're not normally renewable. What happens if you've had your vehicle longer than the permitted timescale? What if your existing GAP insurance policy is approaching expiry but, you're keeping the vehicle beyond the expiry date? Announcing: "Top-UP" GAP insurance If you have a car that is less than 8-years old, which you took delivery of more than 3-months ago and is worth no more than £80,000, Top-Up GAP insurance might be the answer! It's an annual policy and can be renewed as many times as you need until such time as your vehicle reaches 8-years old and with prices starting at just ~£68 per year, it's great value too! How Does It Work? If your car is written off through accident, fire, theft or flood, your Motor Insurance policy is only good for paying you what your vehicle was worth (aka the "Market Value") at the time of loss. Top-Up GAP insurance will top-up that payout by a further 25% (max £10k) and reimburse you up to £250 of any excess paid to your motor insurer too! More information: Click here for more information about and/or to get a quote for Top-Up GAP insurance.

-

GAP insurance and paying off PCP

David@GAPInsurance replied to Ness1812's topic in Insurance & Legal Issues

You appear to have misunderstood what I said - I’m not remotely mistaken! I said that *unlike a motor dealer* (who are notorious for mis-selling and overcharging for GAP insurance) WE make comparatively very little per policy (compared to a motor dealer). You also appear to have missed the part where I said that the average price of our currently live GAP insurance policies covering Skoda vehicles is ~£160 from which we made an average gross margin of ~£40. Now... these currently live policies are a mix of Contract Hire, Invoice (RTI) and Replacement (VRI) GAP insurance policies and their policy durations range from 1 to 5 yrs with the average duration working out at ~3.5 years. That average of £160 breaks down as follows: Retail Premium: £160 Insurance Premium Tax (12%): £17.15 Our gross margin: £40 Net rate (paid to MGA/Insurer): £102.85 Do I have GAP policies with net rates similar to your £72? Sure I do (assuming you’re referring to the Net rate?) I have rates both lower and (considerably) higher than that too but, as I’d expect you to know if you’re in the industry, there’s a range of criteria that has a bearing on the final price to the end user - make & model of vehicle, vehicle value, policy type, duration and claim limit etc - all of which are dictated to us by the MGA/Insurer. Assuming a Skoda motor dealer had an average policy selling price of £399 with same average net rate as ours (£102.85), their financial breakdown would be as follows: Retail Premium: £399 Insurance Premium Tax (20%): £66.50 Their gross margin: £229.65 Net rate (paid to MGA/Insurer): £102.85 If they were selling the policy that you refer to with a net rate of £72, for an average of £399, their financial breakdown would be as follows: Retail Premium: £399 Insurance Premium Tax (20%): £66.50 Their gross margin: £260.50 Net rate (paid to MGA/Insurer): £72 If an insurance broker had your net rate of £72 and sold it out for £399 (aside from the fact that I expect they wouldn’t sell very many) only 12% IPT applies which breaks down as follows: Retail Premium: £399 Insurance Premium Tax (12%): £42.77 Their gross margin: £284.23 Net rate: £72 In short, nobody is earning £322 beer vouchers on a net rate of £72 and an end user price of £399. Out of interest, if £72 is your net rate, what vehicle value, policy duration and claim limit does that permit cover for and how much is your average end-user/retail price? -

GAP insurance and paying off PCP

David@GAPInsurance replied to Ness1812's topic in Insurance & Legal Issues

Thank you @KenONeill. That's exactly how it would work. The policy would aim to pay the difference between your motor insurance payout and the original invoice price that you paid for the vehicle. The fact that there may well still be finance outstanding from the original loan would be a separate issue altogether. Assuming it's a policy like ours that involves a cash payout to the policyholder (rather than a credit to a nominated dealer, for example) it means you'd get all of the money from both insurance claims (motor and GAP) and then you'd be free to choose whether to use any of that money towards paying off the remaining finance or, continuing with your loan repayments and spending the funds as you saw fit. It depends what type of GAP insurance you had. If you had Finance GAP insurance (which would aim to pay the difference between your motor insurance total loss payout and the amount outstanding on finance at the time of claim), then you paying off the finance means there's now no possible shortfall for the policy to pay. If this is the case, you should explore cancelling the GAP insurance policy and seeking a pro-rata rebate of unused premium - although depending on the sums and timescales involved, potential cancellation fees might consume a chunk of what's left. It's still worth querying the cancellation though, particularly if you bought it from a motor dealer as the high price you likely paid for it could well mean the remaining term is worth a reasonable amount. If you have Invoice GAP insurance (aims to pay the difference between your motor insurance payout and the original invoice price paid) or Replacement GAP insurance (aims to pay the difference between your motor insurance payout and the cost of replacing the vehicle with a new equivalent at the time of claim), then clearing the finance has no bearing on the validity of the policy - it (you having cleared the finance by the time of any claim) just means that (as with KenOneill's enqury above) you receive all of the money from both Motor and GAP claims because none of it has to be paid to a finance company. If you bought the GAP insurance from a motor dealer, depending on the timescales involved there's another possible scenario too... until fairly recently it was relatively common for motor dealers to provide (and some still do) a GAP insurance policy for a certain duration (usually 5 years) which was a combination of both Finance & Invoice GAP insurance but after an initial period of time (usually 3 years) the policy would revert to Finance GAP insurance type cover only (the longer duration looked good, went some way towards them attempting to justify the normally absurdly high price they were charging for it, whilst the potential for the policy actually ever having to pay anything in the secondary period was *hugely* reduced). If you have this type of policy and you've paid off the finance during the initial period, you're still covered by the Invoice GAP insurance element for the remainder of that initial period but the cover for the secondary period is now defunct. Do you know what type of GAP insurance you have? -

GAP insurance and paying off PCP

David@GAPInsurance replied to Ness1812's topic in Insurance & Legal Issues

Oh yes. We see our fair share of suspicious claims. Some we can do something about... others we can’t. It’s quite frustrating but thankfully, it’s a minority of claims. Ha! Opening salvo of the second paragraph and I’m like: 😳😥😡 followed quickly by 😂. Thank you @Rustynuts I appreciate that. Andy and I own a business together = He is my business partner. He’s also one of my best mates, confidant and mentor. From January 2018 the shareholding of the business changed to a split that was more in my favour than his - hence the change of control that you quote. I ask again, what is your point? Actually I was going to post that we appear to have inadvertently hijacked your post @Ness1812 - I apologise. For the record, my offer still stands - if you want to discuss your GAP requirements please get in touch. As other members of BRISKODA will testify, your dealings with me/us will always be without pressure or obligation. @john2017 if you’re inclined to discuss further, perhaps open a new thread in the GAP insurance section or take it to PM. Or even by email ([email protected]) / or phone if you wish (number in my signature).

.thumb.jpg.f0e86d2be27be6fdcb438e103680c4c0.jpg)