-

Posts

186 -

Joined

-

Last visited

Content Type

Profiles

Forums

Gallery

Shop

Events

Downloads

Everything posted by David@GAPInsurance

-

Indeed this is true and it's great to see that a decent conclusion was arrived at with the debacle that was Qudos going to the wall however, you were fortunate that in this case an insurance company was prepared to step in and "buy" your policy from the administrators of the now defunct previous insurer. In the event that an insurer goes bust and another insurance company is NOT prepared to buy the risk and allow a continuance of cover, your policy would have been cancelled, and the FSCS would have only been good (assuming you were not wanting to make a claim at that time) for refunding you up to 90% of what you originally paid for your policy. In the event that you'd needed to make a claim before these matters were resolved, the FSCS would have been good for up to 90% of your claim. To be clear, It's pretty much a given that all insurance policies legitimately sold in the UK are covered by the FSCS. But the protection it affords a policyholder has its limits. FOUR off-shore and unrated insurers of GAP Insurance have gone bust since 2016 (Alpha, Enterprise, Elite and most recently Qudos). It's a pattern that is likely to continue as the GAP insurance market hardens and as it does so I predict that the appetite for an insurer to buy the "book" of a failed GAP insurer will wane - in January of this year one of the UK's largest providers of GAP insurance announced that they were no longer accepting new policies on risk and I'm hearing on the grapevine that other major players in the field (albeit primarily supplying motor dealers) are looking to offload their schemes too. If the major players are having to take such action, you can bet there are alarm bells ringing at the smaller, unrated insurers. Thus, I believe a better approach would be to avoid off-shore unrated insurers altogether - they're simply too risky. Our policies for example, are underwritten by a syndicate at Lloyd's of London - an A-rated, UK based entity with financial resources that would take some beating. There's at least one other online provider also using a syndicate at Lloyd's and a small number of other online providers using alternative A-rated insurers but sadly, unrated offshore insurers are rife in the market courtesy of those brokers who are prepared to chase the lowest possible prices at all costs. Are policies from A-rated insurers more expensive? In some cases yes, but not always and even where there is a premium to pay for a policy from a larger, more reputable and stable insurer... it's not usually considerable. In short... "caveat emptor". Policyholders of GAP insurance underwritten by Qudos have been relatively lucky this time around. Policyholders of the next unrated GAP insurer to go bust (and it's only a matter of time) , may not be quite as lucky. HTH

-

Gap insurance

David@GAPInsurance replied to benterrier's topic in Skoda Octavia Mk III (2013 - 2020)

3yr Invoice GAP insurance at £299 is far too expensive. Headline figures... £16,500 vehicle, 3yr Invoice GAP insurance = £139.06 from us after your forum-member discount (use code "BRISKODA10") See here for details of what to look for when selecting a GAP insurance policy: https://www.briskoda.net/forums/topic/463594-how-to-choose-the-best-gap-insurance-policy/ Get a quote at www.gapinsurance.co.uk or give us a call on 01484 490095 Happy to discuss your requirements with you if you wish. David -

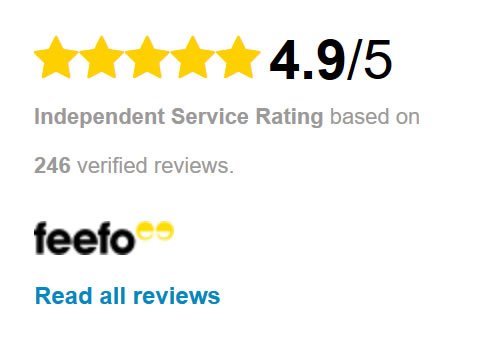

It's that time of year again! In not too long at all, some of us will be lucky enough to be driving around in a brand new motor sporting a 19' plate. The dealer might have already mentioned GAP insurance to you and, may well be psyching themselves up ready for trying to sell it to you tomorrow when you're distracted by the glare from your shiny new car. It's a given that motor-dealer sourced GAP insurance policies are rarely the best choice - if not only for their excessive prices - but when it comes to looking elsewhere and the increasing range of online providers who'll bamboozle you with all sorts of claims as to why their policy is better than the rest... what actually matters? How do you choose the best GAP insurance policy? Below are our top tips for choosing the best GAP insurance policy: #1 - Choose an A-Rated Insurer With FOUR unrated, offshore underwriters of GAP insurance having gone bust since 2016, it's arguably now more important than ever to choose a policy backed by financial resources sufficient enough to ensure that the policy will be there when you need it most. Our GAP insurance policies are underwritten by a syndicate at Lloyd's - a UK entity rated A, AA- and A+ by three of the world's leading insurance rating agencies. More details here. #2 Choose a UK-Based Insurer The FOUR unrated underwriters of GAP Insurance that have gone bust since 2016 were all offshore insurers (two in Gibraltar and two in Denmark). If that's not a pattern worth paying attention to, we don't know what is. "But it's OK if the insurer goes bust, the FSCS will cover you" - is what the companies that sell such policies will tell you. But it's not quite as simple as that. You see if an insurer is in the throws of being wrapped up at the time you need to make a claim then if needs be, the FSCS will cover you for up to 90% of your claim value. But if you're not needing to make a claim at that point, as part of wrapping the company up the administrators will seek to find a buyer of your policy. If another insurer steps in to buy your policy, you get to carry on with your cover intact. However if they don't find a buyer, they'll move to cancel your policy instead. Leaving the FSCS only good for refunding some/all of what you paid for your policy in the first place and, probably, you then too late to seek GAP insurance cover from another provider. Note: "FSCS" is the UK's Financial Services Compensation Scheme. As above, our GAP insurance policies are underwitten by a syndicate at Lloyd's. More details here. #3 - Avoid "Market Value" Clauses "Market Value" clauses in a GAP insurance policies are there to serve one single purpose only: To reduce the amount of money that the GAP insurance policy would otherwise have to pay out. If your Motor Insurer pays out less than the GAP insurer thinks your car is worth, a Market Value clause allows the GAP insurer to avoid paying the perceived under payment by your motor insurer. If you bought a used car, another type of Market Value clause allows the GAP insurer to reduce their payout by any amount by which they believe you over-paid for the vehicle when you first bought it. Getting hit by one Market Value clause is bad enough. Suffer the wrath of two and your payout could potentially be substantially reduced. Our GAP insurance policies have NO Market Value clauses. More details here. #4 - Cash Is King If your car is written off, would you want the GAP insurance payout to be made in the form of a credit to a motor dealer of the GAP insurer's choice? Would you like to be obliged to have the GAP insurer source your next vehicle? What about a GAP insurance policy payout that is quite specifically reduced if you're not intending to replace the vehicle with the funds it pays out? We believe that a GAP insurance policy that pays out in any way other than to leave you with cash in "your pocket" for you to spend as you see fit, is simply too restrictive. Our GAP insurance policies pay out in cash to the policyholder, for them to spend as they see fit. (Note that if there's finance outstanding on the vehicle at the time of claim the finance company get their bit first and the remaining balance is paid to the finance company) More details here. #5 - Get A Quote From GAPinsurance.co.uk Admit it. You saw this one coming - Didn't you? We believe our GAP insurance policies are amongst, if not the best available on the market. They're underwritten by an A-Rated, UK-based insurer, incorporate NO "Market Value" clauses and are designed to leave you with cash in your pocket after any payout. You get a daily pro-rata rebate of unused premium if you cancel your policy and haven't made a claim, which you can then use against the cost of a new policy on a new vehicle and, what's more, our prices are up to 85% lower than you'll pay for GAP insurance from your supplying motor dealer. PLUS (as if you need another reason) we're great! See below for what customers are saying about us online. FINALLY (just for good measure) forum members SAVE a further 10% by using discount code "BRISKODA10". What are you waiting for? Get Contract Hire, Invoice or Replacement GAP Insurance policy quote for your new SKODA, here. What Our Customers Are Saying About Us

-

- 2019 plate

- newcar

-

(and 4 more)

Tagged with:

-

Please be aware that if you're considering GAP insurance, the eligibility criteria for our policies is changing effective from midnight tomorrow night (Monday January 21st 2019). From Tuesday onwards (no exceptions), the following rules will apply: Invoice & Replacement GAP insurance will only be available for a vehicle purchased within the last 90 days (currently 365 days) Contract Hire GAP insurance will only be available for a vehicle that you took delivery of within the last 180 days (currently 365 days) Replacement GAP insurance will only be available for a vehicle that you purchased brand new and are the first registered keeper of (currently available to cover a new/used vehicle up to 5 years old) The maximum policy duration for Invoice & Replacement GAP insurance will be four years (currently five years) In addition, as of Friday last week, it's now no longer possible to defer the start date of a GAP insurance policy - something that you may have considered for a brand new vehicle if the motor insurer provided new-for-old cover during the first year of ownership. Finally, also from Tuesday onwards, a range of vehicles will be excluded from cover. You can see the list of these vehicles here. All the above considered, if you're contemplating GAP insurance and will be affected by any of the above, contact us. HTH GAPinsurance.co.uk

-

If you haven't yet bought GAP insurance for a car that you purchased up to a year ago, you're running out of time. From January 22nd onwards, we'll only be able to sell GAP insurance to cover a car that you bought up to 3 months in the past. If you've been delaying buying GAP insurance with the intention of buying it towards the end of the first year of ownership (e.g. your motor insurer might cover you on a new-for-old basis during the first year of owning a brand new vehicle), now is the time to act before you potentially lose the ability to buy GAP insurance cover at all. In some cases (if you do have new-for-old cover with your motor insurance) we may even be able to permit you to defer the start date of the policy by up to 12 months from when the vehicle was first registered - thereby allowing you to avoid *possible* duplicate cover in the first year but, still benefit from cover in year 2 onwards. January 22nd is a strict deadline which will not change. If you're contemplating GAP insurance, get a quote online today at www.gapinsurance.co.uk or contact us to discuss your requirements on either 01484 490095 or [email protected]. Remember too that forum members get 10% discount using code: "BRISKODA10"

-

Has your GAP insurance underwriter gone bankrupt?

David@GAPInsurance posted a topic in Gap Insurance

October 2016 - Enterprise Insurance (Gibraltar) August 2017 - Elite Insurance (Gibraltar) May 2018 - Alpha Insurance A/S (Denmark) ...and more recently... December 2018 - Qudos Insurance A/S (Denmark) Each of them being unrated, offshore, underwriters lauded at different times by various competitors of ours as the next-best-thing in terms of insurer of GAP insurance... and all since having gone to the wall. There's a reason that we don't pursue the cheapest possible prices at all costs - sure, policies from A-rated insurers may well attract a higher premium but, crucially, they'll almost certainly be there when you need them most! The latest news RE: Qudos Denmark Domiciled 'Qudos Insurance A/S' has now been declared bankrupt. In the UK, Qudos provided a range of insurance products including, GAP insurance (they also did motor insurance, tyre & alloy wheel insurance, scratch & dent insurance as well as pet insurance and accident, sickness and unemployment insurance) Qudos have recently announced that all live policies are to be terminated three months after the notice of the bankruptcy decree (a message repeated in this post from the UK's FCA). Although confusingly, this announcement from Qudos claims that all live policies will be terminated as of November 2019 The announcement from Qudos explains further that claims are to be covered by the Danish Guarantee Fund, but only up until June 20th 2019 after which any claims will be against the bankruptcy estate. The announcement goes on to say that the ability to claim a refund of premium paid for the policy will be online from February 2019. The UK's Financial Services Compensation Scheme has published these guidelines about the failure of Qudos. What should you do if have a Qudos underwritten GAP insurance policy? We know of at least two of our online competitors who were selling GAP insurance policies underwritten by Qudos, within the last 12 months so your options are potentially quite limited because most GAP insurance providers have a time limit within which you have to purchase GAP insurance and not many will allow a new policy to be purchased more than 6-months after taking ownership of the vehicle. Thus, your options would be... Do nothing - and keep your fingers crossed that you don't need to make a claim in the future (for the avoidance of doubt, we're not really serious that this should be considered a valid option) Seek a refund (possibly a transfer to a new insurer) from your original broker - We don't think any of their policies were sold in the last 30 days so you're likely to be well outside of your 30-day cooling off period and unable to get a 100% refund but you should initially speak to the company you purchased the policy from originally and see what they can do for you. It might be that they're willing to refund you (pro-rata or otherwise) and be able to arrange cover with a new provider. The above announcement from the FSCS suggests that your broker may well be able to claim from the FSCS a portion of the refund due to you, and use that against the cost of a new policy from a new provider. However, we believe it's also possible that they may just refer you to the online facility which Qudos will be putting live in February 2019 though. Seek cover elsewhere - We (for example) sell GAP insurance underwritten by large, reputable, A-rated insurers and at present can provide cover up to a year after you took delivery of the vehicle. This is for a limited time though because from January 22nd onwards we'll only be able to provide GAP insurance for a vehicle you purchased within the last 90 days. It should be worth noting that the FSCS will only cover you for up to 90% of any claim value or, in the event of cancellation of your policy, up to 90% of any refund of premium that you are due as a result. Consider those sums for a minute... and take action sooner rather than later in order to at east try to ensure that you maintain some kind of cover in place! Obviously, you need to have this out with the original broker that you sourced your policy from first. After doing so, if you want to have a chat about your options for cover from a reputable A-rated insurer, feel free to contact us on either 01484 490095 or email [email protected]. HTH -

If you’re leasing a vehicle, at some point you’re almost certainly going to be on the receiving end of a sales pitch for Contract Hire GAP insurance. If it’s not the motor dealer or agent that does it prior to you taking delivery of the vehicle, it’ll be the motor dealer’s customer services team or, the finance company themselves that contact you by letter, email or phone once you’ve already taken delivery. If you’re really “lucky” – it might be ALL of them! But do you need GAP insurance for a leased vehicle? The answer is… not always, no! Read more on our blog.

-

SAVE: Use discount code "BRISKODA10" to save 10% off our GAP insurance, Tyre & Alloy and Scratch & Dent insurance policies. What Is GAP insurance? GAP insurance covers you in the event that your vehicle is written off through accident, fire, theft or flood. Your motor insurer will only pay you what they think your car is worth at the time of loss, whilst GAP insurance will then step in to pay you an additional sum of money which varies subject to the type of GAP insurance policy you purchase. On average our GAP insurance policies have paid out an average of ~£7,312 per claim on SKODA vehicles that have been written off. The largest claim we've paid to date for a written off SKODA was £10,275 - the largest GAP insurance claim we've paid to date full stop, was £48,859! You can see more GAP insurance details and statistics at: https://www.gapinsurance.co.uk/gap-insurance-statistics.asp Invoice GAP insurance: Aims to pay the difference between your motor insurance payout and the greater of either: The amount outstanding on finance at the time of claim, or The original invoice price that you paid for your vehicle originally (after discount). See here for more details: www.gapinsurance.co.uk/invoicegap Replacement GAP insurance: Aims to pay the difference between your motor insurance payout and the greater of either: The amount outstanding on finance at the time of claim, or The original invoice price that you paid for your vehicle originally (after discount), or What it would cost at the time of claim to replace your vehicle with a vehicle of the same (or nearest equivalent) make, model, specification, age and mileage as was relevant to your vehicle at the time you first bought it (e.g. if you bought a brand new vehicle originally, it'd be looking at the cost of a brand new equivalent at the time of claim). See here for more details: www.gapinsurance.co.uk/replacementgap Contract Hire GAP insurance Aims to pay the difference between your motor insurance payout and the amount required to settle the remaining balance of your Contract Hire agreement. You can even pay a small additional payment to ensure that if your leased vehicle is written off, you'll be reimbursed the initial payment you put down. See here for more details: www.gapinsurance.co.uk/contracthiregap (Though please note that not all Contract Hire GAP agreements require GAP insurance - Contact us for more details.) Clearly terms and conditions apply, so please visit the links above for full details or, get in touch with us on either 01484 490095 or [email protected] to discuss your circumstances further. SAVE: Use discount code "BRISKODA10" to save 10% off our GAP insurance, Tyre & Alloy and Scratch & Dent insurance policies.

-

Is a second term of GAP insurance worth it?

David@GAPInsurance replied to Gaz's topic in Insurance & Legal Issues

That surprises me Gaz - perhaps it's a case of "unwilling" more than "unable". It's a shame though, I'd have thought they'd want your business. -

Is a second term of GAP insurance worth it?

David@GAPInsurance replied to Gaz's topic in Insurance & Legal Issues

Gaz, It's not enormously excessive but, I think £161 is expensive. Consider that if you'd have just bought that car for £17,250 and wanted 3yr Invoice GAP insurance for it, we'd be charging you £113.84 for a policy with a £10k claim limit (albeit only covering up to £250 of your motor insurance excess payable in the event of a total loss claim). Sadly I can't offer you a policy for a vehicle you've owned for more than a year but, I can say that you should definitely press whoever the provider is, for a better price. In the event of a Total Loss, the motor insurer's job is supposed to be, to put the policyholder back in to the position they were in immediately before the incident that led to the vehicle being declared a Total Loss. That is to say that if the PH had a 3yr old vehicle with 40,000 miles on the clock, in theory the market value payout from the motor insurer *should* allow the PH to buy a 3yr old version of the same vehicle with circa 40,000 miles on the clock. Now, we all accept that a motor insurer may low-ball their initial offer and that there may well be some effort required on the part of the PH to get them to raise their offer but that's another tale altogether. The GAP insurance is insuring a different, albeit related, risk - that being the difference ("gap") between the decreasing market value of the covered vehicle and (in the case of Invoice GAP insurance) the original invoice price paid.... one (the motor insurer) is covering a risk which usually diminishes with time whilst the other (the gap insurance) is covering a risk which increases with time. Agreed Value motor insurance policies do exist but, they're usually the territory of specialist/custom/classic vehicles only. You are correct of course that if a motor insurer was to protect the full original vehicle purchase price or, even better the full retail price of the "new" equivalent at the time of claim then yes, GAP insurance wouldn't be necessary however... I think it would be a very brave motor insurer who elected to write policies in this manner because they'd only be able to do so with a substantial price increase and as we also all know, the car-insurance market is incredibly price-sensitive as it is. In the defence of motor insurers though... for brand new vehicles, lots of motor insurers do cover them on a new-for-old basis within the first year - although this in itself isn't without its potential pitfalls. -

Is a second term of GAP insurance worth it?

David@GAPInsurance replied to Gaz's topic in Insurance & Legal Issues

I sell GAP insurance for a living so clearly I'm biased - I think having GAP insurance in place is always a good idea but, this should obviously be weighed up against your attitude to the risk (which if you've had a vehicle previously written off, I'm guessing you're more concerned that others who haven't experienced it may be) and ultimately what price you're prepared to put on the peace of mind that GAP insurance affords you. Further, you also need to consider by how much more your car is likely to depreciate. E.g. if the car is now 3yrs old and worth £13k, the value of the vehicle won't drop away from that £13k anything like as much/fast as it dropped away from its original list/purchase price when you first bought it. How much have you been quoted for the further 3-year cover and what value have they placed on the vehicle? (I don't mind checking the value out for you if you want to PM me the registration number and a mileage reading). HTH -

GAP Insurance Quote

David@GAPInsurance replied to Ursicles's topic in Skoda Octavia Mk III (2013 - 2020)

Great -

GAP Insurance Quote

David@GAPInsurance replied to Ursicles's topic in Skoda Octavia Mk III (2013 - 2020)

Good evening Folks. I thought I might take the opportunity to point out a few things here: Not all lease (e.g. Contract Hire) agreements need GAP insurance. It depends on the specific terms of your contract but generally speaking if the finance company is VWFS there's usually a need for it, but with some companies (LEX for example), there's often no need. It's worth checking. If you need help working this out, please speak to us. With three budget GAP insurers based in Gibraltar and Denmark having gone bust since 2016 (Enterprise, Elite and in recent weeks Alpha) it'd be wise to stick with larg(er) A-Rated insurers. This can sometimes attract a premium but not usually considerable. Our Contract Hire GAP insurance policy is almost identical to the one offered by ALA except for the fact that in the event you cancel your policy early and wish to take the unused premium back as a refund, they'll deduct a cancellation fee. We won't. BRISKODA members get 10% discount off our prices using discount code "BRISKODA10". See www.gapinsurance.co.uk for more details. @Ursicles - I *think* our price after forum-member discount is probably going to be somewhere in the region of £89 but, if you'd care to share a few more details with me via DM I'd happily look to see if I'm able to beat your price of £84. HTH -

GAP insurance still works for used vehicles, afterall with the march of time, most vehicles depreciate in value from their original purchase price and therein lies the "gap". As for whether you "need" GAP? It's really a matter of your personal preference in terms of the potential risk of the car being written off through accident, fire, theft or flood... when weighed up against the cost of and your desire for protecting against that risk. We offer two types of GAP insurance which in the event of your vehicle being written off, work as follows: Invoice GAP insurance Aims to pay the difference between your motor insurance payout and the greater of either: 1. The amount outstanding on finance at the time of claim (where applicable) or 2. The original invoice price (after discount) that you paid for the vehicle when you first bought it. Replacement GAP insurance Aims to pay the difference between your motor insurance payout and the greater of either: 1. The amount outstanding on finance at the time of claim (where applicable) or 2. The original invoice price (after discount) that you paid for the vehicle when you first bought it or 3. What it would cost at the time of claim to replace your vehicle with one of the same (or nearest equivalent) make, model, specification, age and mileage as was relevant to your original vehicle at the time you bought it. Prices.... To give you an indication of price... if you were looking at say, a 3yr policy with a £7,500 Claim Limit (the most that the policy would be prepared to pay out in addition to what you receive from your motor insurer) our prices would be as follows: Invoice GAP insurance @ £124.86 less BRISKODA10 discount = £112.37 Replacement GAP insurance @ £148.29 less BRISKODA10 discount = £133.46 At an equivalent of either £37.46 or £44.49 per year we take the view that it's a small price to pay for benefit that could run in to £000's of pounds but, only you can really decide whether you believe that to be good value or not. Note that other durations (1-5 years) and claim limits (£5k to £Unlimited) are available. If you'd like an alternative quote please either visit GAPinsurance.co.uk for more details or, call us on 01484 490095. If you have any other questions, please don't hesitate to ask either here or via DM or via email to [email protected] - whichever you prefer. Best wishes David

-

vRS245 ordered club

David@GAPInsurance replied to themanwithnoaim's topic in Skoda Octavia Mk III (2013 - 2020)

LOVE those wheels! -

That's great. Thank you Jamie. Glad you got it sorted.

-

I'm sorry Jamie, I don't believe I received a notification for your message that you posted and have just stumbled across it. Did you get sorted with GAP insurance?

-

Thank you for your custom and feedback Andy - much appreciated!

-

Hello Siobhan, If you've purchased the vehicle (either cash outright or financed it), then whether you go for Invoice or Replacement GAP insurance comes down to a matter of personal preference and/or budget. Replacement GAP insurance is technically the superior of the two policies but that also means it's therefore more expensive. In a nutshell, the different policies work as follows in the event that your vehicle is written off through accident, fire, theft or flood: Invoice GAP Insurance Aims to pay the difference between your motor insurance payout and the greater of either: The amount outstanding on finance at the time of claim, or The original invoice price that you paid for your vehicle. Replacement GAP insurance Aims to pay the difference between your motor insurance payout and the greater of either: The amount outstanding on finance at the time of claim, or The original invoice price that you paid for your vehicle, or What it would cost at the time of claim to replace your vehicle with a brand new version of the same (or nearest equivalent) vehicle. In terms of working out what level (Claim Limit) to go for, that will depend on the duration of cover you require and the policy type. If you happen to have financed the vehicle by way of a PCP agreement, a good start would be to take the invoice price you paid for it and deduct from that the sum of the final payment due at the end of the PCP term. The resulting figure should ideally be the minimum claim limit you consider for an Invoice GAP insurance policy covering the same duration as the PCP term. A Replacement GAP insurance policy *may* warrant a slightly higher claim limit but, not always. You can find out more info on our website: www.gapinsurance.co.uk or if you wish, give us a call on 01484 490095. We're more than happy to talk through all of your options with you and give you as much information as you require to make an informed decision as to whether to proceed with GAP insurance or not. We're not a motor dealer, there's no sales tricks or obligation etc. Just good, solid, advice - as others on this forum will testify. Of course if you have any questions and prefer to ask them via this forum (either in public or via PM) then that's fine with us too. I hope this helps. David

-

vRS245 ordered club

David@GAPInsurance replied to themanwithnoaim's topic in Skoda Octavia Mk III (2013 - 2020)

The last time I saw a VWFS agreement it held you liable for all of the shortfall but their settlement figure did involve a discount of (I think) 4%. It shouldn’t be taken for granted that all VWFS contracts are the same. For example I’ve seen Volvo Car Leasing agreements that don’t hold you liable for any of the shortfall and others that would hold you liable for all of the shortfall. Clearly Volvo isn’t VWFS but, my point is that I wouldn’t assume they’re all the same one way or the other, it’s always worth checking. Although, not checking and assuming you’re liable for all of any shortfall and buying GAP insurance to cover it, is potentially the less expensive assumption of the two. David -

vRS245 ordered club

David@GAPInsurance replied to themanwithnoaim's topic in Skoda Octavia Mk III (2013 - 2020)

Thanks for the referral @Wet Kipper We can indeed assist you with GAP Insurance (along with Scratch & Dent, Tyre and Alloy Wheel insurance too if you're so inclined). Contract Hire/Lease GAP insurance, Invoice GAP insurance & Replacement GAP insurance at prices already up to 85% cheaper than a motor dealer will charge you plus BRISKODA members get 10% further discount using code "BRISKODA10". Check out our website for more details: www.gapinsurance.co.uk or give us a shout on either 01484 490095 or [email protected] for assistance. Just something to consider... @shyVRS245 and @Reddazforever commented above that most people leasing a vehicle would take out Lease GAP insurance (what we call Contract Hire GAP Insurance). It's worth noting though that not all lease agreements require GAP Insurance. The basic logic is that in the event that your leased vehicle is declared a Total Loss, there'll often be a shortfall between what your motor insurer pays out and what the finance company want in settlement - because the settlement figure from the finance company is usually arrived at by adding together the value of your vehicle before it was written off (this should be circa the same amount that your motor insurer paid out) PLUS the sum of all rentals not yet paid. They then may add on an administration fee and they may or may not grant you some discount. Some lease agreements are such that you're liable for ALL of the shortfall. Some are such that you're only liable for SOME (usually a percentage) of the shortfall. Some lease agreements are such that you're NOT LIABLE FOR ANY of the shortfall. It therefore pays to check the terms of your lease agreement to see if you actually need it before buying Lease/Contract Hire GAP insurance. If you have a leased car and you're unsure, we'll gladly take a look at your agreement and let you know whether you need it or not. HTH David -

Indeed, dealer prices are just daft. Consider us next time though (unless you haven't bought it yet, then consider us this time too :-)) Pretty much identical policies to the ones sold by ALA save for the fact that they charge you a cancellation fee if you cancel the policy early (e.g. if you sell the vehicle) and want the unused premium to be refunded, whilst we don't charge cancellation fees at all plus, we're usually cheaper AND BRISKODA members get 10% discount too.

-

Did you get a quote from us for the GAP insurance?

-

Was your GAP insurance purchased from the dealer?

-

Replacement GAP insurance is superior to the Invoice GAP insurance policy peddled by other brokers and motor dealers - particularly if you're buying a brand new SKODA! Whilst having an Invoice GAP insurance policy get you back to the original invoice price that you paid in the event of a Total Loss is clearly nothing to be sniffed at, what happens if the price of a present-day brand new equivalent SKODA is more expensive at the time of claim, than when you first bought your car? Therein lies the benefit of Replacement GAP insurance. However it doesn't stop there, our Replacement GAP insurance is the best of all three types of GAP insurance (Finance, Invoice & Replacement GAP Insurance) rolled in to one. There is no higher form of GAP insurance available. What is Replacement GAP insurance from GAPinsurance.co.uk? In the event of your vehicle being written off through accident, fire, theft or flood, Replacement GAP insurance will cover the difference between your motor insurance payout and the greater of either: The amount outstanding on finance at the time of claim, or The original invoice price that you paid for your vehicle, or What it would cost at the time of claim to replace your vehicle with a brand new version of the same* (or nearest equivalent) vehicle again. * - If your original vehicle was not purchased brand new, the replacement vehicle value would be based at the time of claim, on one of the same (or nearest equivalent) vehicle make, model, specification, age and mileage as was relevant to your original vehicle at the time you first bought it Cover features: Cash payouts to you as the policyholder, leaving you free to use the funds against the cost of any vehicle from any dealership your choice. Cover available for durations of 1, 2, 3, 4 or 5 years. Defer the start date of the policy by up to 1-year from first registration if your motor insurer covers you on a new-for-old basis in the first year (1-4yr policies only) Claim limits available ranging from £5,000 to £Unlimited Available for cars purchased for up to £150,000 Cover vehicles purchased up to 365 days ago Add on cover for up to £2,000 of Negative Equity brought forward from a previous vehicle. Covers up to £250 of the excess payable under your motor insurance policy in the event of a Total Loss claim Underwritten by an A-Rated insurer who's parent company is one of the largest insurance companies in the world Available for vehicles that are up to 5 years old at the time of purchasing the policy No mileage limits £50,000 vehicle example: Other brokers might provide you with a 3-year Invoice GAP insurance policy incorporating a £20,000 Claim Limit for £216 but... £217.21* with us gets you a 3-year Replacement GAP insurance policy with an £Unlimited Claim Limit! * - Use discount code "BRISKODA10" Get a quote today: Save up to 85% compared to what your motor dealer might charge you and get superior cover too. Check us out at www.gapinsurance.co.uk or call us on 01484 490095 Also available: Invoice GAP insurance Contract Hire GAP insurance Scratch & Dent insurance Tyre Insurance Alloy Wheel Insurance BRISKODA.net Members get 10% discount of ALL of our products using code: "BRISKODA10" What our customers say: ***** Excellent company to deal with. Fortunately I've not had to use the insurance, but setting up a policy is very straightforward as is setting up a new one when changing vehicles. They have allowed me to cancel my existing policy before it expired as I am changing vehicles, with a pro-rata refund on the previous policy being used against the new policy (or it's offered as a refund direct to my bank account). Tim has helped me with this and saved me a great deal of money. Highly recommended. P. Brownsword, Ford Grand C-Max ***** I would strongly recommend this company. My car was written off and my claim was processed with efficiency and speed and I am very happy with the outcome. Outstanding customer service from David and the team. The competitively priced premium is probably the best investment I have ever made. Thank you. S. Maughan, Hyundai i10 ***** Outstanding value compared to the dealership's sky high prices. S. Street, Porsche Boxster ***** I can't recommend these highly enough. Handled my claim quickly and nothing was too much trouble and no question to trivial . Just taken out my second policy with them hope i never need to use it but know I will get excellent service if I do. H. Lewington, Vauxhall Corsa ***** Excellent customer service, problems sorted first time, would recommend! K. James, Toyota Yaris ***** Fantastic service. Tom was helpful both on line via chat and when I took out the policy via phone The saving compared to dealer quote was amazing £230.00 cheaper! M. Newby, Citroen DS3

-

- replacement gap

- invoice gap

-

(and 2 more)

Tagged with: